Table of Contents

When people talk about business profits or company performance, you might hear the term EBITA. But what exactly does it mean? If you’re scratching your head, don’t worry. You’re not alone. The EBITA meaning can sound complicated at first, but it’s really easy to understand once it’s broken down. In this article, we’ll explain what EBITA is, why it matters, how it’s used, and how it helps people understand a company’s true financial health. We’ll keep everything simple, friendly, and clear—so even if you’re new to business terms, you’ll feel confident by the end.

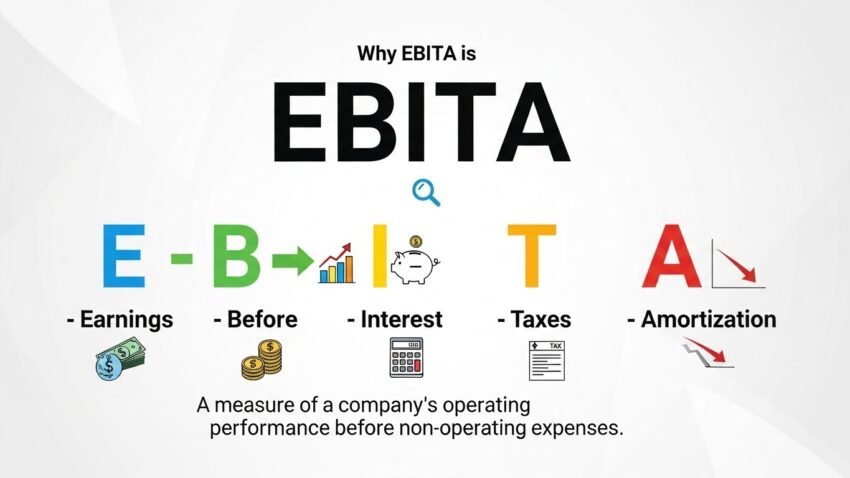

What Does EBITA Stand For?

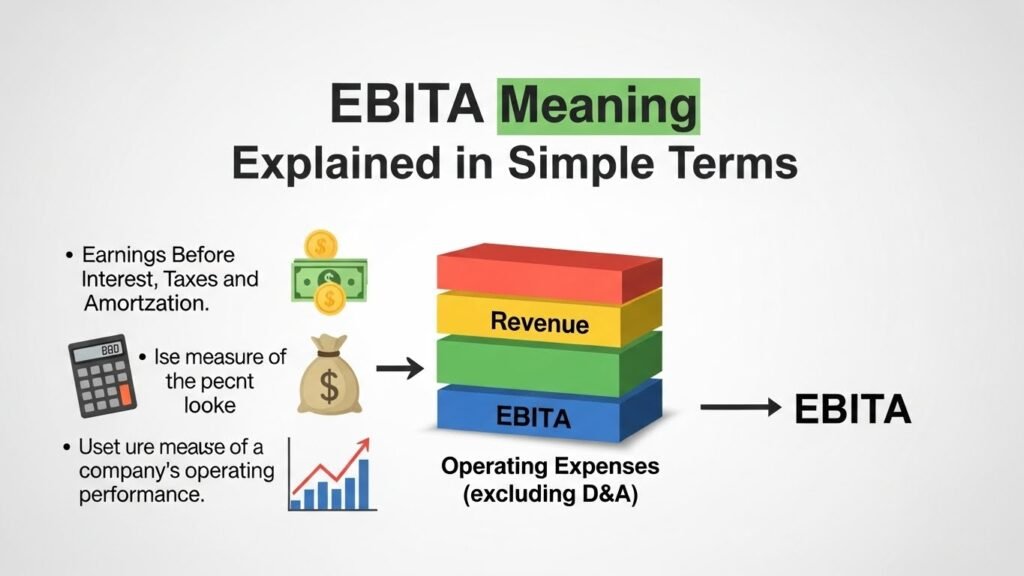

Let’s start with the basics. EBITA stands for Earnings Before Interest, Taxes, and Amortization. That’s a lot of words, but here’s what they mean. “Earnings” is just another word for profit. The other parts—interest, taxes, and amortization—are specific things a company pays out or accounts for over time. So, EBITA is the profit a company makes before subtracting money for interest, taxes, and amortization. It’s a way to look at how much money a company is actually making from its main business activities, without letting outside costs or accounting rules influence the number too much.

Breaking Down the Elements of EBITA

To really understand the EBITA meaning, it helps to break down each part.

- Earnings = A company’s profit from selling its products or services.

- Before Interest = It ignores costs from borrowed money or loans.

- Taxes = It doesn’t count how much money the company owes in taxes.

- Amortization = It removes the cost spread over time for things like business purchases or investments.

Removing these costs helps people understand how well the actual business is doing on its own, without outside factors. That’s why many investors use EBITA to compare companies more fairly.

How Is EBITA Different From EBITDA?

Many people confuse EBITA and EBITDA, and it’s an easy mistake. Both are similar financial tools, but here’s the key difference: EBITA doesn’t include amortization, while EBITDA removes both depreciation and amortization.

- Depreciation is how much value a physical item (like a car or machine) loses over time.

- Amortization, on the other hand, involves spreading out the cost of non-physical items like patents or brand value.

So, EBITA includes depreciation but not amortization. It still focuses on a company’s core earnings but adds a bit more reality by keeping depreciation in the picture. It helps investors get a clearer look at how well a company is performing.

Why Do Businesses Use EBITA?

Understanding the EBITA meaning is important because it’s used all the time in business discussions. Companies use it to show how well their operations are performing before dealing with interest payments, taxes, or big-purchase costs that aren’t part of day-to-day operations. Investors like EBITA because it evens the playing field, especially when comparing companies across different industries or countries. Some companies pay more taxes or spend money differently on assets—that doesn’t necessarily mean they’re doing worse. EBITA gives people a clearer, more simple overview of real business success.

How Is EBITA Calculated?

Calculating EBITA is actually easier than it looks! Here’s a simple formula:

EBITA = Net Income + Interest Expense + Taxes + Amortization

Let’s look at an example. Suppose a company has:

- Net income of $100,000

- Pays $10,000 in interest

- Pays $20,000 in taxes

- Has $5,000 in amortization

EBITA = 100,000 + 10,000 + 20,000 + 5,000 = $135,000

This means the company made $135,000 before counting those extra items. This number gives you a clearer picture of how the business is doing from its main operations alone.

Real-Life Example of EBITA in Action

Let’s say a toy company earned $2 million in profits. But after paying $200,000 in interest on loans, $300,000 in taxes, and $100,000 in amortization, their final net income shown is just $1.4 million.

That looks okay, but it hides how well the company really operated. Investors can use EBITA to add those extra costs back in and better measure their actual performance.

EBITA = $1.4 million + $200,000 + $300,000 + $100,000 = $2 million

Now you see the full picture. The toy company still had strong earnings before outside costs. Knowing the EBITA meaning helps investors see that the business is still healthy at its core.

Advantages of Using EBITA

The EBITA meaning has many benefits for business owners, investors, and financial analysts. One key benefit is comparability. Two companies may look very different on paper but have similar EBITA figures, showing they’re equally strong once outside costs are removed.

Another benefit is simplicity. It focuses on how well a company is running its core business.

EBITA is also useful for operations planning. It helps managers spot weak areas and fix them before they become bigger issues. Plus, if a company is planning to sell itself or borrow money, showing a strong EBITA can help increase its value in the eyes of lenders and buyers.

Limitations of Relying Only on EBITA

Even though EBITA meaning offers great insights, it does have limits. First, it can hide the effects of interest and taxes, which are very real expenses for any company. If ignored completely, it may give a too-positive picture.

Also, it leaves out amortization, which may be hiding big investment decisions or costs related to buying businesses, intellectual property, or software systems.

Relying only on EBITA without looking at the bigger financial picture can sometimes mislead investors. That’s why smart professionals use EBITA alongside other important numbers like EBITDA, net income, and cash flow.

When Should You Use EBITA?

The best time to use EBITA is when comparing operational performance between companies, especially across different sectors. For example, a heavy manufacturing business pays very differently than a tech startup. EBITA takes the unusual costs out and gives a clearer view of daily performance.

It’s also helpful during mergers or acquisitions, when companies want to show the strength of their core operation without all the accounting fluff.

And if a business has large amortization expenses that can throw off normal profit numbers, EBITA helps bring attention back to consistent profits, not past investments.

What Industries Use EBITA Most?

The EBITA meaning is most helpful in industries where amortization is large and ongoing. For example, tech, media, or pharma companies often pay high prices for patents, licenses, or intellectual property. Instead of having these costs make their income look bad, they use EBITA to show their real strength.

Private equity firms and investment banks also use EBITA a lot during buyout talks. They look at how efficiently a company runs before other factors like taxes or big loans get involved.

In short, any industry with unusual financial structures or high non-cash expenses finds EBITA very useful.

Difference Between EBITA, EBITDA, and EBIT

Understanding EBITA meaning also helps when you compare it to similar terms:

- EBIT = Earnings Before Interest and Taxes

- EBITA = EBIT + Amortization

- EBITDA = EBITA + Depreciation

So, starting from EBIT, each step adjusts for one more non-operating cost. EBITDA removes both amortization and depreciation. EBITA removes just amortization. These tools give different views of business performance. The “right one” depends on what you want to learn about the company.

Why EBITA Appeals to Investors

Investors and analysts like using EBITA because it gives a clean, simple way to tell how strong a business is. It filters out “noise” from things like past debt payments or non-cash items and focuses on what’s happening right now in the core business.

It helps them compare companies, spot valuable purchase targets, or judge which firm is best run. It doesn’t replace the need for full investigation, but it does give a quick and solid place to start.

It’s also handy for startups or growing firms that may still have high costs from earlier expansions but are now operating profitably.

FAQs

What is the full EBITA meaning?

EBITA stands for Earnings Before Interest, Taxes, and Amortization. It measures profit before these specific costs are subtracted.

How is EBITA different from EBITDA?

EBITA excludes amortization only, while EBITDA removes both amortization and depreciation to give an even wider view of profit.

Is EBITA useful for comparing companies?

Yes, it helps investors compare companies by removing outside costs so they can focus on core performance.

Why do some analysts prefer EBITA?

Because it shows how profitable a company’s main business is, without outside distractions like taxes or one-time costs.

Can I use EBITA for small businesses?

Sure! Even small businesses can look at EBITA to track how well they’re running day-to-day operations.

Is EBITA always positive if a company is doing well?

Not always. If EBITA is negative, it means the company isn’t making enough profit from its core activities, which is a warning sign.

Final Thoughts

The EBITA meaning may sound complex at first, but once you break it down, it’s a super valuable tool. It helps you look past the confusing details and get right to the core of how well a business is doing. Whether you’re an investor, a business owner, or just someone curious about finance, understanding EBITA gives you a real advantage. Use it wisely—along with other key numbers—and you’ll be smarter when it comes to reading income statements, spotting business trends, or making investment decisions. The numbers are there. Now you know what they truly mean.