Table of Contents

If you’ve ever felt lost trying to figure out your student loans, you’re not alone. Many people who work in public service dream of getting their loan balance forgiven, but the process can feel confusing and slow. That’s where the PSLF Help Tool comes in. It’s a free online tool from the U.S. Department of Education that helps you figure out if you qualify for the Public Service Loan Forgiveness (PSLF) program—and helps you apply too. This guide makes everything simple and clear. We’ll walk you through how the PSLF Help Tool works, who can use it, and how it can help you finally move closer to becoming debt-free.

What Is the PSLF Program?

The Public Service Loan Forgiveness (PSLF) program was made for people who work in public service jobs. If you work full-time for the government or a nonprofit and make 120 eligible monthly payments, you could have your remaining student loan balance forgiven. That means the rest of your loan is erased—completely. But not everyone who thinks they qualify actually does. That’s why the PSLF Help Tool is so useful. It makes sure your job, loan type, and payments match the program’s rules.

What Exactly Is the PSLF Help Tool?

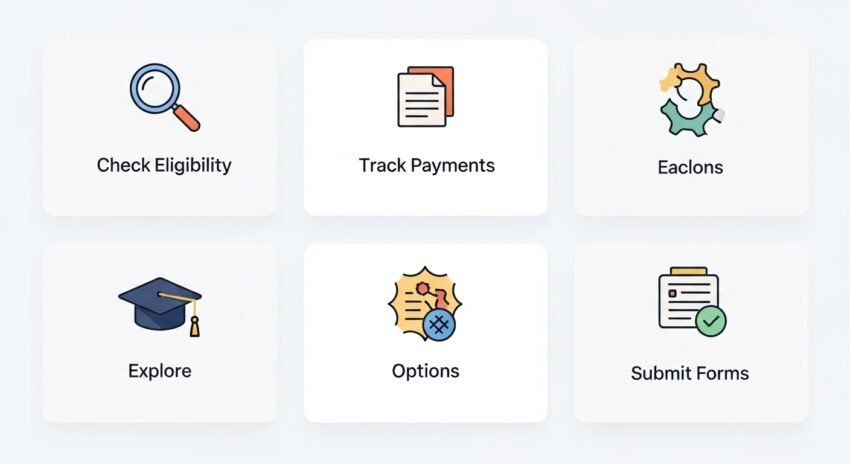

The PSLF Help Tool is an online tool created by the U.S. Department of Education. It helps borrowers see if their job counts as public service, check their loan type, and guide them through the PSLF application process. It’s like having a smart assistant that walks you through all the steps. Instead of reading through tons of confusing documents, the tool asks you simple questions and gives you clear answers. Best of all, it’s free and easy to use. You’ll find it on the official StudentAid.gov website, and it’s available 24/7.

Who Should Use the PSLF Help Tool?

If you work in a job like teaching, military service, firefighting, nonprofit management, or anything in local, state, or federal government, you should definitely check out the PSLF Help Tool. Even if you’re not sure if you qualify, the tool can help you check. It’s also helpful if you’ve made many payments over the years and want to see how many count toward forgiveness. New and long-time borrowers alike can benefit. Whether you’ve just heard about PSLF or you’ve been trying for years, this tool can clear up confusion.

Step-by-Step: How to Use the PSLF Help Tool

Using the PSLF Help Tool is simple and only takes about 30 minutes. First, go to StudentAid.gov and log into your account with your FSA ID. If you don’t have one, you can create it quickly. Once inside, go to the PSLF Help Tool section. The tool will ask you about your employer, your job title, and your loan details. You’ll also enter your work dates and basic information. After answering all the questions, the tool will tell you if your job qualifies. Then, it helps you fill out the PSLF form, which you can print and send to your loan servicer or e-sign electronically, depending on your employer.

Why the PSLF Help Tool Matters (Now More Than Ever)

The rules around student loan forgiveness have changed a lot in the past few years. There have been temporary waivers and new updates—and many people missed out because they didn’t know. That’s where the PSLF Help Tool really shines. It’s always updated with the latest rules. So you won’t be stuck relying on outdated info from random websites. If you used the tool before a rule change, it’s worth using it again. Even if something didn’t count last year, it might count now. Thousands of people have suddenly qualified after using the tool because of these updates.

Avoiding Common PSLF Mistakes with the Help Tool

Many people make small mistakes that cost them years of progress toward forgiveness. Maybe the loans weren’t eligible, or the job didn’t count. Some people were even making the right payments—but under the wrong loan program. The PSLF Help Tool helps catch these mistakes. For example, it tells you if your loans need to be consolidated, or if your payments don’t count. It can even help you switch loan plans if needed. Instead of guessing, the tool gives you solid answers based on your real loan data.

How the PSLF Help Tool Checks Employer Eligibility

One of the most confusing parts of PSLF is figuring out if your employer qualifies. That’s where many borrowers get stuck. But the PSLF Help Tool includes a built-in database of public service employers. When you type in your employer’s name and tax ID (EIN), the tool checks if it matches a valid public service organization. If it’s not on the list, the tool lets you still apply and submit documentation for review. That means you don’t have to play detective or call around for answers. The tool makes it clear and official.

Understanding Your Loan Type with the PSLF Help Tool

Not all student loans qualify for forgiveness through PSLF. Only loans under the Direct Loan program are eligible. That means if you have FFEL (Federal Family Education Loans) or Perkins Loans, they need to be consolidated first. The PSLF Help Tool looks at your loan types and tells you exactly what you have. If you need to consolidate, it guides you through the next steps. This is super helpful because loan names often sound alike. The tool makes it crystal clear if your loan needs changes before you qualify.

How to Track Your Progress Toward PSLF

Wouldn’t it be nice to see how many qualifying payments you’ve made? The PSLF Help Tool helps you keep track. After submitting your application through the tool, your servicer will review your payment history and send regular updates. You don’t need to keep notes on a spreadsheet or second-guess your progress. The Department of Education has improved how these counts are tracked, and they’ve made it easier than ever to stay informed. Now you can feel more confident knowing exactly where you stand.

Real Stories: How the PSLF Help Tool Changed Lives

Thousands of teachers, nurses, public defenders, and service members have already benefited from using the PSLF Help Tool. For example, Sarah, a school teacher in California, thought she didn’t qualify. But after using the tool, she learned her school and loan type both fit the program. She submitted her paperwork and got over $50,000 in debt forgiven within two years. David, a firefighter, discovered errors in his monthly payment history. With the help tool, he corrected them and got credit for three more years of service—getting him much closer to forgiveness. Stories like these show that the tool isn’t just helpful—it’s life-changing.

Tips to Get the Most from the PSLF Help Tool

To get the best results from the PSLF Help Tool, have the following info ready: your FSA ID, employer name and EIN, your employment start/end dates, and details about your federal student loans. Double-check your entries to avoid delays. Also, use the tool every year—or when you switch jobs—to submit your Employment Certification Form (ECF). This keeps your account up to date and avoids surprises later. If your employer lets you sign forms electronically, choose that option—it’s faster and simpler. Using the tool regularly keeps your progress on track and helps make the road to loan forgiveness smoother.

How to Follow Up After Using the Tool

Once you use the PSLF Help Tool to submit your application or ECF, make sure to follow up. Your loan servicer will reach out after reviewing your form. Keep an eye on your email or physical mail for updates. If something isn’t clear or if they ask for more documents, don’t wait—reply quickly. You can also log in to your StudentAid account and check your PSLF progress. Remember, this is your future—we’re talking thousands of dollars. A little follow-up can go a long way toward faster forgiveness.

FAQs

What is the PSLF Help Tool?

The PSLF Help Tool is an online tool from the U.S. Department of Education that helps you apply for Public Service Loan Forgiveness, check if your employer qualifies, and guide you step-by-step.

Is the PSLF Help Tool free to use?

Yes, it’s 100% free. You can find it on StudentAid.gov and use it anytime with your FSA ID.

Can I still qualify if I made payments under the wrong plan?

Maybe. Recent PSLF updates have allowed many borrowers to count past payments that didn’t previously qualify. Use the tool to find out.

Do I need to use the PSLF Help Tool every year?

It’s a good idea. Submitting your Employment Certification Form yearly through the tool keeps your progress updated and avoids problems later.

What if my employer isn’t listed in the tool’s database?

You can still submit your employer information manually. The Department of Education will review it to decide if it qualifies.

Can I use the help tool if I no longer work in public service?

Yes, but you only qualify for forgiveness if you make 120 eligible payments while working full-time in public service. The tool can help confirm your history and next steps.

Conclusion

Student loan forgiveness doesn’t have to feel like a mystery. With the PSLF Help Tool, you have everything you need to check your eligibility, apply with confidence, avoid mistakes, and track your progress. The tool is free, easy to use, and backed by the Department of Education. Whether you’re just starting your PSLF journey or have been working in public service for years, using the PSLF Help Tool could be the turning point. Don’t leave money on the table. Take 30 minutes today, explore the tool, and move one step closer to becoming debt-free. Your future—and your peace of mind—are worth it.